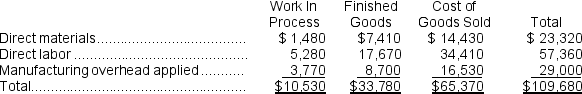

Stangl Inc.has provided the following data for the month of September.There were no beginning inventories; consequently,the direct materials,direct labor,and manufacturing overhead applied listed below are all for the current month.

Manufacturing overhead for the month was underapplied by $3,000.

Manufacturing overhead for the month was underapplied by $3,000.

The company allocates any underapplied or overapplied overhead among work in process,finished goods,and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.

Required:

Determine the cost of work in process,finished goods,and cost of goods sold AFTER allocation of the underapplied or overapplied overhead for the period.

Definitions:

Investing Activity

Financial activities related to acquiring or disposing of non-current assets, such as property, plant, and equipment, which are recorded on a company's cash flow statement.

Cash Dividends

Dividends paid by a company to its shareholders in the form of cash.

Purchase Of Land

The acquisition of land for business operations or investment, recorded as a fixed asset in the company's balance sheet.

Revenue Recognition Principle

An accounting principle that dictates the specific conditions under which revenue is recognized or recorded in the accounts.

Q4: The estimated total manufacturing overhead is closest

Q6: Greenham Corporation uses the weighted-average method in

Q8: Marston Corporation uses the FIFO method in

Q29: In the first step of the allocation,the

Q76: The fact that one department may be

Q89: Easy Inc.uses the FIFO method in its

Q108: Hutchcroft Corporation uses the weighted-average method in

Q121: The total cost transferred from the first

Q152: The applied manufacturing overhead for the year

Q164: The amount of overhead applied in the