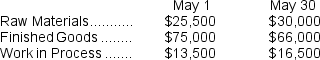

Tyare Corporation had the following inventory balances at the beginning and end of May:

During May, $58,500 in raw materials (all direct materials) were drawn from inventory and used in production. The company's predetermined overhead rate was $12 per direct labor-hour, and it paid its direct labor workers $15 per hour. A total of 300 hours of direct labor time had been expended on the jobs in the beginning Work in Process inventory account. The ending Work in Process inventory account contained $7,050 of direct materials cost. The Corporation incurred $42,000 of actual manufacturing overhead cost during the month and applied $39,600 in manufacturing overhead cost.

During May, $58,500 in raw materials (all direct materials) were drawn from inventory and used in production. The company's predetermined overhead rate was $12 per direct labor-hour, and it paid its direct labor workers $15 per hour. A total of 300 hours of direct labor time had been expended on the jobs in the beginning Work in Process inventory account. The ending Work in Process inventory account contained $7,050 of direct materials cost. The Corporation incurred $42,000 of actual manufacturing overhead cost during the month and applied $39,600 in manufacturing overhead cost.

-The direct materials cost in the May 1 Work in Process inventory account totaled:

Definitions:

Fair Value

An estimate of the market value of an asset or liability based on current prices in active markets for similar assets or liabilities.

Lessee

A Lessee is a person or entity who leases an asset from another, the lessor, under a lease agreement.

Lessor

A lessor is the party that leases or rents a property or asset to another party, known as the lessee.

Capital Lease

A lease arrangement that is recorded as an asset on the lessee's balance sheet, essentially treated as a purchase of the leased asset for accounting purposes.

Q3: The unit product cost of product P93S

Q10: The cost per equivalent unit for materials

Q55: Frankin Corporation has provided the following data

Q63: What are the equivalent units for conversion

Q76: The fact that one department may be

Q104: When materials are purchased in a process

Q198: The overhead for the year was:<br>A) $2,792

Q200: Chipata Corporation applies manufacturing overhead to jobs

Q236: The manufacturing overhead was:<br>A) $200 overapplied<br>B) $2,700

Q272: Helland Corporation uses a job-order costing system