Dacosta Corporation had only one job in process on May 1. The job had been charged with $1,800 of direct materials, $6,966 of direct labor, and $9,936 of manufacturing overhead cost. The company assigns overhead cost to jobs using the predetermined overhead rate of $18.40 per direct labor-hour.

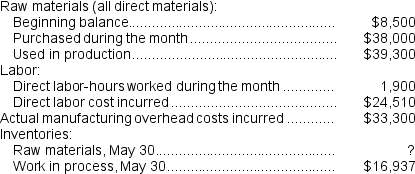

During May, the following activity was recorded:

Work in process inventory on May 30 contains $3,741 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.

Work in process inventory on May 30 contains $3,741 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.

-The entry to dispose of the underapplied or overapplied manufacturing overhead cost for the month would include a:

Definitions:

Labor Supplied

Refers to the total hours of work that workers are willing and able to provide at a given wage rate over a certain period.

Income Effect

The change in an individual's or economy's income and how that change will impact the quantity demanded of a good or service.

Substitution Effect

The change in consumption patterns due to a change in the relative prices of goods, leading a consumer to substitute one good for another.

Labor Supplied

Represents the total hours that workers are willing and able to work at a given wage rate.

Q12: Walbin Corporation uses the weighted-average method in

Q13: The step-down method ultimately results in less

Q30: The equivalent units for materials for March,using

Q31: Conversion cost is the sum of direct

Q34: Walker Enterprises,Inc.,uses a job-order costing system and

Q59: If the applied manufacturing overhead was $223,900,the

Q59: The estimated total manufacturing overhead for the

Q77: Darrow Corporation uses a predetermined overhead rate

Q92: Tarrant Corporation has two manufacturing departments--Casting and

Q141: The estimated total manufacturing overhead is closest