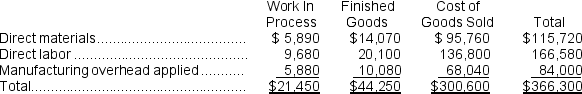

Held Inc. has provided the following data for the month of June. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month.

Manufacturing overhead for the month was overapplied by $1,000.

Manufacturing overhead for the month was overapplied by $1,000.

The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.

-The cost of goods sold for June after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to:

Definitions:

Homogeneous

Characteristics of products or services that are identical in quality and features, making them indistinguishable from one another in the eyes of consumers.

Fast-Food Industry

The fast-food industry comprises businesses that serve quick service food items over the counter or via drive-thrus, often emphasizing speed, convenience, and affordability.

Marginal Revenue

The additional income generated from selling one more unit of a good or service.

Total Revenue

Total Revenue is the full amount of income generated by the sale of goods or services before any costs are deducted.

Q8: The manufacturing overhead applied is closest to:<br>A)

Q17: Levi Corporation uses a predetermined overhead rate

Q21: The total amount of Administrative Department cost

Q46: The cost per equivalent unit for materials

Q61: Farsat Inc.uses the FIFO method in its

Q66: Which of the following statements is true?

Q69: The cost of ending work in process

Q189: Advertising costs should NOT be charged to

Q209: The total job cost for Job M598

Q284: Product costs that have become expenses can