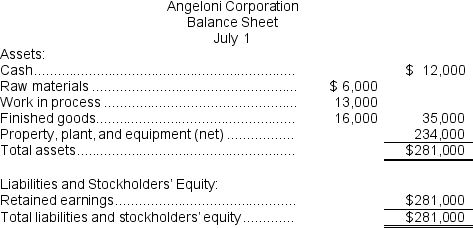

Angeloni Corporation uses a job-order costing system to assign manufacturing costs to jobs.At the end of the month it closes out any overapplied or underapplied manufacturing overhead to Cost of Goods Sold.Its balance sheet on July 1 appears below:

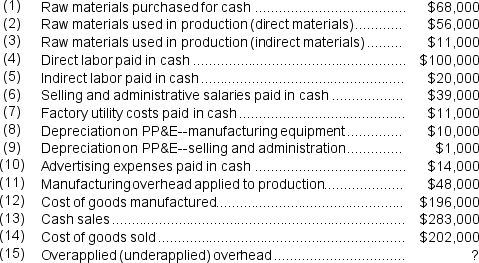

Summaries of the transactions completed during July appear below:

Summaries of the transactions completed during July appear below:

Required:

Required:

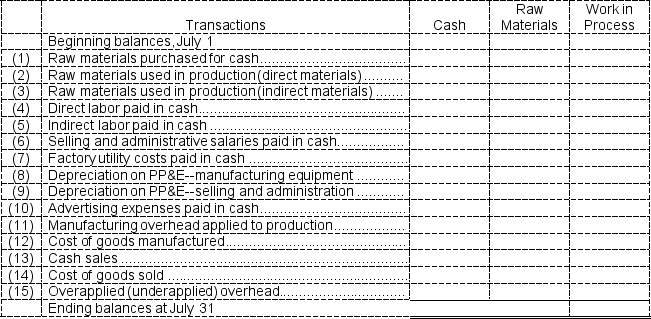

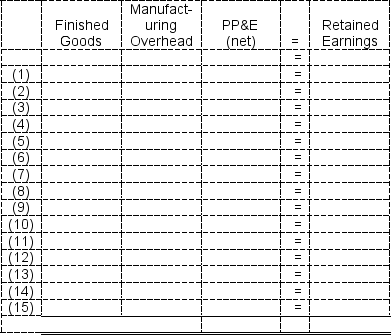

a.Completely fill in the spreadsheet below.Because the page is too narrow to accommodate all of the columns,the spreadsheet has been divided into two parts that should be side by side.

b.Prepare a Schedule of Cost of Goods Sold for the company for July.

b.Prepare a Schedule of Cost of Goods Sold for the company for July.

c.Prepare an Income Statement for the company for July.

Definitions:

Trading Securities Portfolio

A collection of marketable securities that a business holds for the purpose of reselling them in the short term to profit from market price changes.

Fair Value

An estimate of the price at which an asset or liability could be traded in an orderly transaction between market participants at the measurement date.

Adjusting Entry

An accounting journal entry made at the end of an accounting period to allocate income and expenditure to the appropriate period.

Trading Portfolio

A collection of financial assets such as stocks, bonds, commodities, currencies, and derivatives held by an investor, primarily for the purpose of short-term speculation.

Q11: Spivey Corporation has two service departments and

Q16: The equivalent units for materials for the

Q26: The following data have been provided by

Q26: The total amount of Information Technology Department

Q57: Two of the reasons why manufacturing overhead

Q62: Steven Corporation uses the FIFO method in

Q156: In account analysis,an account is classified as

Q210: The total amount of overhead applied in

Q250: Advertising is not a considered a product

Q277: Selling costs are indirect costs.