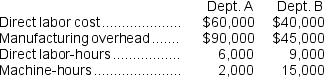

The Silver Corporation uses a predetermined overhead rate to apply manufacturing overhead to jobs.The predetermined overhead rate is based on labor cost in Dept.A and on machine-hours in Dept.B.At the beginning of the year,the Corporation made the following estimates: What predetermined overhead rates would be used in Dept.A and Dept.B,respectively?

What predetermined overhead rates would be used in Dept.A and Dept.B,respectively?

Definitions:

Quantity Demanded

The total amount of a good or service that consumers are willing and able to purchase at a given price level in a given time period.

Direct;Inverse

Direct refers to a relationship between two variables that move in the same direction, while inverse indicates a relationship where one variable increases as the other decreases.

Inferior Goods

Goods for which demand decreases as the income of consumers increases, opposite to normal goods where demand increases with rising income.

Ramen Noodles

A fast-cooking type of noodle dish, often sold in packets or cups, known for its convenience and low cost, originating from Japan.

Q35: Lamberson Corporation uses a job-order costing system

Q41: Ryans Corporation uses a job-order costing system

Q58: The Silver Corporation uses a predetermined overhead

Q79: Merced Corporation has a process costing system

Q82: Materials used in a factory that are

Q91: In the department's cost reconciliation report for

Q116: If the activity level increases,then one would

Q146: If 3,000 units are produced,the total amount

Q194: Direct labor cost is classified as:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2580/.jpg"

Q207: If 3,000 units are produced,the total amount