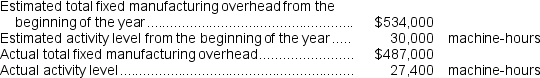

Baj Corporation uses a predetermined overhead rate base on machine-hours that it recalculates at the beginning of each year.The company has provided the following data for the most recent year.  The predetermined overhead rate per machine-hour would be closest to:

The predetermined overhead rate per machine-hour would be closest to:

Definitions:

Amortization

The method of slowly amortizing the initial expense of a non-physical asset over the period it is expected to be used.

Units-Of-Output Method

A depreciation method where the expense is based on the actual output or usage of the asset, rather than the passage of time.

Double-Declining-Balance Method

A method of accelerated depreciation that doubles the straight-line depreciation rate, leading to higher depreciation expenses in the initial years of asset use.

Straight-Line Method

A method of allocating the cost of a tangible asset over its useful life in equal periodic amounts.

Q3: The unit product cost of product P93S

Q53: The total job cost for Job K332

Q63: Matthias Corporation has provided data concerning the

Q69: The estimated total manufacturing overhead for the

Q74: If the company marks up its manufacturing

Q98: Cai Corporation uses a job-order costing system

Q199: Faughn Corporation has provided the following data

Q204: How much is the cost of goods

Q233: Baj Corporation uses a predetermined overhead rate

Q264: The predetermined overhead rate for the Finishing