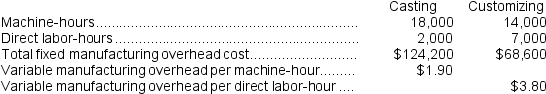

Mahon Corporation has two production departments,Casting and Customizing.The company uses a job-order costing system and computes a predetermined overhead rate in each production department.The Casting Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours.At the beginning of the current year,the company had made the following estimates: During the current month the company started and finished Job T138.The following data were recorded for this job:

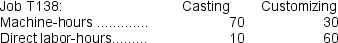

During the current month the company started and finished Job T138.The following data were recorded for this job: The amount of overhead applied in the Customizing Department to Job T138 is closest to:

The amount of overhead applied in the Customizing Department to Job T138 is closest to:

Definitions:

Valuation Allowance Accounts

Accounts used to reduce the carrying value of assets to an amount that approximates their fair value, especially when it is impossible to realize the entry value.

Balance Sheet Accounts

Financial accounts that are reported in the balance sheet, including assets, liabilities, and equity accounts, representing a company's financial position at a specific point in time.

Trading Investments

Securities bought and held primarily for selling them in the near term to profit from their price fluctuations.

Other Comprehensive Income

A component of total comprehensive income that includes unrealized gains and losses affecting shareholders' equity not included in net income.

Q13: If the company bases its predetermined overhead

Q41: Suppose the company uses the step-down method

Q48: Under the FIFO method of product costing,equivalent

Q73: Falkenstein Corporation uses a job-order costing system

Q119: A credit balance in the Manufacturing Overhead

Q137: Almaraz Corporation has two manufacturing departments--Forming and

Q165: Valvano Corporation uses a job-order costing system

Q219: The predetermined overhead rate for the Finishing

Q235: For financial reporting purposes,the total amount of

Q262: The predetermined overhead rate for the Machining