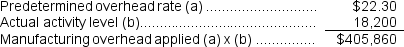

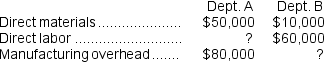

-Grib Corporation uses a predetermined overhead rate based on direct labor cost to apply manufacturing overhead to jobs.The predetermined overhead rates for the year are 200% of direct labor cost for Department A and 50% of direct labor cost for Department B.Job 436,started and completed during the year,was charged with the following costs: The total manufacturing cost assigned to Job 436 was:

The total manufacturing cost assigned to Job 436 was:

Definitions:

Storage Area

A designated space or room used for storing goods, materials, or equipment, often arranged to maximize space efficiency and preserve the condition of the stored items.

Smaller Than Standard

Refers to an object or measurement that is less than the accepted or usual size or dimension.

Sheet Protector

A Sheet Protector is a clear plastic cover designed to protect documents from damage or wear, typically used in binders or for presentation.

Inspecting

The act of examining something closely in order to determine its condition or quality.

Q16: Wofril Corporation uses the cost formula Y

Q36: Kahanaoi Corporation is a manufacturer that uses

Q49: The total amount of overhead applied in

Q69: The estimated total manufacturing overhead for the

Q71: What are the Fermenting Department's equivalent units

Q84: Assume that the company uses departmental predetermined

Q88: Assume that the company uses a plantwide

Q155: The amount of overhead applied in the

Q164: Able Corporation uses a job-order costing system.In

Q189: Indirect costs,such as manufacturing overhead,are variable costs.