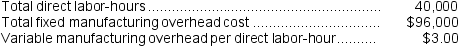

Dehner Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:

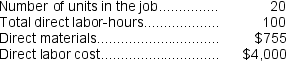

Recently, Job P951 was completed with the following characteristics:

Recently, Job P951 was completed with the following characteristics:

-The total job cost for Job P951 is closest to:

Definitions:

Perpetual Inventory System

An immediate inventory recording technique utilizing computerized point-of-sale systems and enterprise asset management software to document sales or purchases.

Freight In

The cost of transportation or shipping of raw materials or goods into a production facility or warehouse.

Periodic Method

An accounting system where inventory values and cost of goods sold are determined at the end of an accounting period.

Cost of Goods Sold

Costs directly linked to the manufacturing of products sold by a business, encompassing the expenses of materials and labor specifically employed in the product's production.

Q9: Mccaughan Corporation bases its predetermined overhead rate

Q64: Testor Products uses a job-order costing system

Q73: Falkenstein Corporation uses a job-order costing system

Q118: Bierce Corporation has two manufacturing departments--Machining and

Q129: Tenneson Corporation's cost of goods manufactured for

Q155: Wages paid to production supervisors would be

Q161: For financial reporting purposes,the total amount of

Q167: The unit product cost for Job X455

Q240: The total amount of manufacturing overhead applied

Q291: Coates Corporation uses a job-order costing system