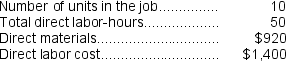

Beans Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $162,000, variable manufacturing overhead of $2.80 per direct labor-hour, and 60,000 direct labor-hours. Recently, Job K818 was completed with the following characteristics:

-The amount of overhead applied to Job K818 is closest to:

Definitions:

U.S. Constitution

The supreme law of the United States, outlining the national frame of government, the division of powers, and the rights and protections of citizens.

Safeguards

Measures implemented to protect against harm, damage, theft, or unauthorized access.

Federal

Relating to the central government of a federation rather than state, local, or provincial authorities.

State Courts

Judiciary bodies within individual U.S. states responsible for interpreting and applying state laws and constitutions.

Q96: Assuming that Owens Corporation uses the FIFO

Q107: To the nearest whole dollar,what should be

Q169: An example of a committed fixed cost

Q225: During June,Buttrey Corporation incurred $67,000 of direct

Q233: Baj Corporation uses a predetermined overhead rate

Q252: Alberta Corporation uses a job-order costing system.The

Q271: If 5,000 units are sold,the total variable

Q272: Helland Corporation uses a job-order costing system

Q280: The incremental manufacturing cost that the company

Q289: Comparative income statements for Boggs Sports Equipment