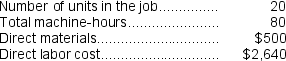

Levron Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $58,000, variable manufacturing overhead of $2.00 per machine-hour, and 20,000 machine-hours. The company has provided the following data concerning Job P978 which was recently completed:

-The predetermined overhead rate is closest to:

Definitions:

Operating Cash Inflow

Cash generated from a company's primary business operations, excluding non-operational sources like investments or financing.

Capital Budgeting

The process of evaluating and selecting long-term investments that are in line with the goal of maximizing a firm's value through strategic asset allocation.

Straight-Line Depreciation

A depreciation method where an asset's purchase cost is uniformly divided across its usable life, providing an equal expense charge each year.

After-Tax Discount Rate

The interest rate used to discount future cash flows to their present value after accounting for the effects of taxes.

Q34: Maccari Corporation uses the FIFO method in

Q41: Ryans Corporation uses a job-order costing system

Q79: Merced Corporation has a process costing system

Q97: Which costs will change with a decrease

Q104: Which of the following is correct concerning

Q174: The predetermined overhead rate is closest to:<br>A)

Q175: The Cost of Goods Manufactured was:<br>A) $19,900<br>B)

Q222: As the level of activity increases,how will

Q241: A number of costs are listed below.<br>

Q246: Prayer Corporation has two production departments,Machining and