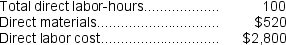

Kubes Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $90,000, variable manufacturing overhead of $3.50 per direct labor-hour, and 30,000 direct labor-hours. The company has provided the following data concerning Job A477 which was recently completed:

-The predetermined overhead rate for the Assembly Department is closest to:

Definitions:

Accounts Payable

Obligations or debts a company owes to its suppliers or vendors for products or services received.

Direct Method

A costing methodology that directly assigns specific costs to relevant objects without using allocation for indirect costs.

Cost Of Goods Sold

Costs directly related to the goods a company sells, covering both the materials' cost and the labor cost involved in making the product.

Balance Sheet Accounts

These are the accounts that reflect the financial position of a business at a specific point in time, including assets, liabilities, and equity.

Q2: The unit product cost of product R78S

Q20: The management of Michaeli Corporation would like

Q54: In December,one of the processing departments at

Q82: The raw materials purchased during May totaled:<br>A)

Q155: St.Johns Corporation uses a job-order costing system

Q193: Session Corporation uses a job-order costing system

Q200: Chipata Corporation applies manufacturing overhead to jobs

Q205: The estimated total manufacturing overhead is closest

Q256: The predetermined overhead rate is closest to:<br>A)

Q280: The incremental manufacturing cost that the company