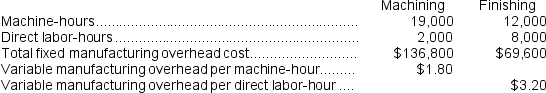

Kalp Corporation has two production departments, Machining and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Machining Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

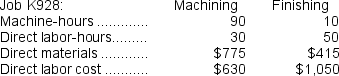

During the current month the company started and finished Job K928. The following data were recorded for this job:

During the current month the company started and finished Job K928. The following data were recorded for this job:

-The estimated total manufacturing overhead for the Machining Department is closest to:

Definitions:

Fiscal Period

A specific time period for which an organization prepares financial statements, typically a year, but can also be a quarter or month.

Deferred Expense

A deferred expense is an expenditure that is made in advance and recorded as an asset until it is consumed or its value expires, at which point it is charged to expense.

Accrual Basis

An accounting method where transactions are recorded when they are earned or incurred, regardless of when cash is exchanged.

Matching Concept

An accounting principle that requires the expenses to be matched with the revenues they helped to generate in the same accounting period.

Q2: Holmstrom Corporation has provided the following data

Q6: Brothern Corporation bases its predetermined overhead rate

Q9: The manufacturing overhead that would be applied

Q10: In the Excel,or spreadsheet,approach to recording financial

Q27: The manufacturing overhead applied is closest to:<br>A)

Q62: The predetermined overhead rate is closest to:<br>A)

Q72: Lotz Corporation has two manufacturing departments--Casting and

Q88: Under a job-order costing system,the dollar amount

Q96: Firlit Corporation incurred $69,000 of actual Manufacturing

Q242: Bassett Corporation has two production departments,Milling and