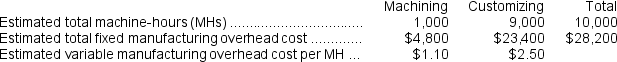

Janicki Corporation has two manufacturing departments--Machining and Customizing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:

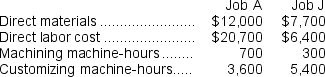

During the most recent month, the company started and completed two jobs--Job A and Job J. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job A and Job J. There were no beginning inventories. Data concerning those two jobs follow:

-Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours and uses a markup of 50% on manufacturing cost to establish selling prices.The calculated selling price for Job J is closest to:

Definitions:

SEC

The Securities and Exchange Commission, a U.S. government oversight agency responsible for regulating the securities markets and protecting investors.

IRS Form

Official documents published by the Internal Revenue Service for taxpayers to report financial information.

Compliance

Adherence to laws, regulations, guidelines, and specifications relevant to a business or operation.

Registered Public Company

A business entity that has completed the required processes to offer its shares to the general public through a stock exchange.

Q3: Fanelli Corporation,a merchandising company,reported the following results

Q47: The adjusted cost of goods sold for

Q71: Hougham Corporation uses a job-order costing system

Q111: A factory supervisor's wages are classified as:<br><img

Q112: The cost formula for selling and administrative

Q182: How much is the total manufacturing cost

Q188: The conversion cost for November was:<br>A) $187,000<br>B)

Q189: Advertising costs should NOT be charged to

Q203: Assume that the company uses a plantwide

Q204: Mcewan Corporation uses a job-order costing system