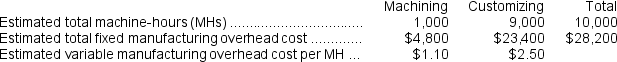

Janicki Corporation has two manufacturing departments--Machining and Customizing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:

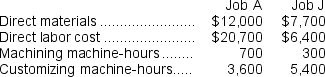

During the most recent month, the company started and completed two jobs--Job A and Job J. There were no beginning inventories. Data concerning those two jobs follow:

During the most recent month, the company started and completed two jobs--Job A and Job J. There were no beginning inventories. Data concerning those two jobs follow:

-Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments.Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices.The calculated selling price for Job A is closest to:

Definitions:

Straight-Line Basis

An approach to determine depreciation or amortization by equally distributing an asset's cost throughout its usable life.

Residual Value

The estimated value of an asset at the end of its useful life, often considered in depreciation calculations.

Estimated Useful Life

The expected service life of an asset to the present owner

Q34: At an activity level of 8,400 units

Q53: The work in process inventory at the

Q76: What are the equivalent units for conversion

Q138: Bellucci Corporation has provided the following information:<br><img

Q209: If 8,000 units are produced,the total amount

Q222: The following accounts are from last year's

Q224: Assume that the company uses a plantwide

Q260: The amount of overhead applied in the

Q263: Which of the following statements is correct

Q265: The cost of lubricants used to grease