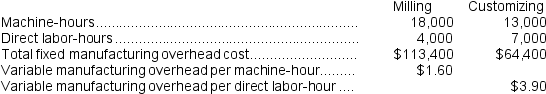

Comans Corporation has two production departments, Milling and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

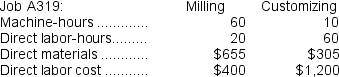

During the current month the company started and finished Job A319. The following data were recorded for this job:

During the current month the company started and finished Job A319. The following data were recorded for this job:

-The amount of overhead applied in the Milling Department to Job A319 is closest to:

Definitions:

Evoking Pity

Causing others to feel sorrow or compassion, often by presenting a sad or unfortunate situation.

Irrelevant Consideration

A factor or argument introduced into a discussion that has no bearing on the issue at hand.

Verbal Disputes

Arguments or disagreements that arise from differences in the definition or interpretation of words rather than substantive issues.

Meaning of Words

The significance or interpretation of words as understood in a particular language or context.

Q5: If the company bases its predetermined overhead

Q31: Danaher Woodworking Corporation produces fine furniture.The company

Q42: If 5,000 units are produced,the total amount

Q47: Gabel Inc.is a merchandising company.Last month the

Q128: The estimated total manufacturing overhead for the

Q155: St.Johns Corporation uses a job-order costing system

Q167: The total of the manufacturing overhead costs

Q199: Faughn Corporation has provided the following data

Q211: The relevant range concept is applicable to

Q231: At the beginning of the year,manufacturing overhead