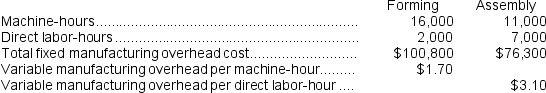

Gercak Corporation has two production departments,Forming and Assembly.The company uses a job-order costing system and computes a predetermined overhead rate in each production department.The Forming Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours.At the beginning of the current year,the company had made the following estimates:

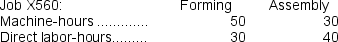

During the current month the company started and finished Job X560.The following data were recorded for this job:

During the current month the company started and finished Job X560.The following data were recorded for this job:

Required:

Required:

a.Calculate the estimated total manufacturing overhead for the Assembly Department.

b.Calculate the predetermined overhead rate for the Forming Department.

c.Calculate the total amount of overhead applied to Job X560 in both departments.

Definitions:

Equity Method

An accounting technique used by firms to assess the profits earned through their investment in other companies by reporting these earnings as income.

Amortization

The gradual reduction of a debt over a period of time through regular payments.

Equity in Subsidiary Earnings

Equity in subsidiary earnings represents the share of profits (or losses) from a subsidiary that is recognized by the parent company, directly proportional to its ownership stake.

Outstanding Stock

The total number of a company's shares that are currently owned by investors, including restricted shares.

Q24: In classifying the costs of quality at

Q31: Danaher Woodworking Corporation produces fine furniture.The company

Q97: Cannizzaro Corporation uses a job-order costing system

Q104: When Vonage decided to increase its sales

Q126: Assume that the company uses departmental predetermined

Q129: A manufacturing company prepays its insurance coverage

Q138: The amount of overhead applied in the

Q169: The total job cost for Job A578

Q219: For financial reporting purposes,the total amount of

Q257: If 8,000 units are produced,the total amount