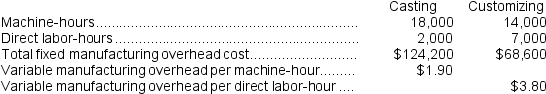

Mahon Corporation has two production departments,Casting and Customizing.The company uses a job-order costing system and computes a predetermined overhead rate in each production department.The Casting Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours.At the beginning of the current year,the company had made the following estimates: During the current month the company started and finished Job T138.The following data were recorded for this job:

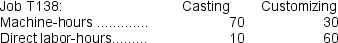

During the current month the company started and finished Job T138.The following data were recorded for this job: The amount of overhead applied in the Customizing Department to Job T138 is closest to:

The amount of overhead applied in the Customizing Department to Job T138 is closest to:

Definitions:

Preferred Stock

A class of ownership in a corporation that has a higher claim on assets and earnings than common stock, often with fixed dividends.

Selling

The process or act of offering goods or services in exchange for money or other compensation.

Tax Rate

The percentage at which an individual or corporation is taxed, with the rate often varying based on income or profit levels.

Beta

A measure of a stock's volatility in comparison to the overall market, indicating its relative riskiness.

Q6: Under the traditional costing system,what would be

Q32: What was the cost per equivalent unit

Q55: For an automobile manufacturer,the cost of a

Q64: Mundorf Corporation has two manufacturing departments--Forming and

Q154: Pasko Corporation uses a job-order costing system

Q162: Swango Corporation has two production departments,Casting and

Q191: Matrejek Corporation has two manufacturing departments--Forming and

Q220: Plasencia Corporation is a manufacturer that uses

Q233: Baj Corporation uses a predetermined overhead rate

Q296: The total of the period costs listed