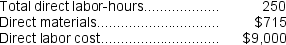

Branin Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $160,000, variable manufacturing overhead of $3.40 per direct labor-hour, and 80,000 direct labor-hours. The company has provided the following data concerning Job A578 which was recently completed:

-The amount of overhead applied to Job A578 is closest to:

Definitions:

Total Period Cost

The sum total of all expenses incurred by a business within a specific period, not directly tied to the production process.

Variable Costing

An accounting method that includes only variable production costs—direct materials, direct labor, and variable manufacturing overhead—in the cost of a unit of product.

Unit Product Cost

The total cost associated with producing a single unit of product, including direct materials, direct labor, and allocated overhead.

Absorption Costing

An accounting practice that aggregates all costs related to making a product, including the expenses for direct materials, the wages for direct labor, and every overhead cost, fixed or changing, into the product’s pricing.

Q9: In the cost reconciliation report under the

Q12: If 4,000 units are sold,the variable cost

Q23: In the Excel,or spreadsheet,approach to recording financial

Q32: Bernson Corporation is using a predetermined overhead

Q39: Under the FIFO method,in addition to the

Q51: What are the equivalent units for materials

Q53: How many units were in the beginning

Q78: Conversion cost is the same thing as

Q179: Moscone Corporation bases its predetermined overhead rate

Q202: The following costs were incurred in May:<br><img