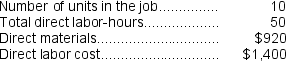

Beans Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $162,000, variable manufacturing overhead of $2.80 per direct labor-hour, and 60,000 direct labor-hours. Recently, Job K818 was completed with the following characteristics:

-The estimated total manufacturing overhead is closest to:

Definitions:

Competitive Market

A market structure characterized by a large number of buyers and sellers, similar products offered by the competing businesses, and a negligible amount of market control held by each seller.

Coconuts

The large, oval, brown seed of a tropical palm, containing a clear liquid and a white, edible flesh.

Fish

Aquatic, gill-bearing animals that lack limbs with digits.

Comparative Advantage

The ability of an entity to produce a good or service at a lower opportunity cost than its competitors, leading to a more efficient allocation of resources.

Q14: The manufacturing overhead that would be applied

Q17: In the Excel,or spreadsheet,approach to recording financial

Q25: Using the FIFO method,the equivalent units for

Q49: The total amount of overhead applied in

Q82: Gaba Corporation uses the FIFO method in

Q99: The journal entry to record the allocation

Q174: Janeway Corporation uses a job-order costing system

Q200: Chipata Corporation applies manufacturing overhead to jobs

Q211: Amason Corporation has two production departments,Forming and

Q270: If Lonnie were to sell 42,000 units,the