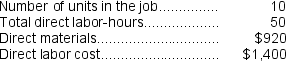

Beans Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $162,000, variable manufacturing overhead of $2.80 per direct labor-hour, and 60,000 direct labor-hours. Recently, Job K818 was completed with the following characteristics:

-The predetermined overhead rate is closest to:

Definitions:

Owner's Equity

The owner's residual interest in the assets of a business after deducting liabilities, representing the net assets owned by shareholders.

Creditorship Claim

This term does not technically exist in precise financial terminology as presented; it's possibly a mistaken combination of terms relating to claims or rights held by creditors.

Ownership Claim

The legal right or interest that an owner possesses in property, assets, or a company, granting the power to control or dispose of it.

Debtor Claim

A demand for repayment from a debtor; may refer to the legal right to demand money owed.

Q26: For financial reporting purposes,the total amount of

Q27: Feuerborn Corporation uses a job-order costing system

Q77: Darrow Corporation uses a predetermined overhead rate

Q87: If 5,000 units are sold,the total variable

Q98: Claus Corporation manufactures a single product and

Q135: If 6,000 units are produced,the total amount

Q140: Gallon Corporation had $24,000 of raw materials

Q151: Karvel Corporation uses a predetermined overhead rate

Q214: The journal entry to record the allocation

Q214: Kavin Corporation uses a predetermined overhead rate