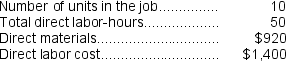

Beans Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $162,000, variable manufacturing overhead of $2.80 per direct labor-hour, and 60,000 direct labor-hours. Recently, Job K818 was completed with the following characteristics:

-If the company marks up its unit product costs by 40% then the selling price for a unit in Job K818 is closest to:

Definitions:

Indirect Labor

Workers who assist in the production process but cannot be directly traced to specific units of product, such as maintenance staff or supervisors.

Variable Cost

Costs that vary directly with the level of production or sales, such as materials and labor.

Direct Labor-Hours

A measure of the time workers spend directly manufacturing a product or providing a service.

Fixed And Variable Cost

Fixed costs are expenses that do not change with the level of production or sales, such as rent, while variable costs fluctuate with production volume, such as materials and labor.

Q6: In the Excel,or spreadsheet,approach to recording financial

Q12: If 4,000 units are sold,the variable cost

Q47: Crone Corporation uses the FIFO method in

Q49: The cost of electricity for running production

Q56: The predetermined overhead rate is closest to:<br>A)

Q66: In a contribution format income statement for

Q91: Easterling Corporation uses a job-order costing system.The

Q134: Obermeyer Corporation uses a job-order costing system

Q167: The total of the manufacturing overhead costs

Q227: The adjusted cost of goods sold that