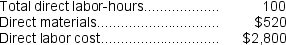

Kubes Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $90,000, variable manufacturing overhead of $3.50 per direct labor-hour, and 30,000 direct labor-hours. The company has provided the following data concerning Job A477 which was recently completed:

-The amount of overhead applied to Job A477 is closest to:

Definitions:

Operating Income

Earnings before interest and taxes (EBIT), an indicator of a company's profitability from its core business activities, excluding non-operating income and expenses.

Break-even Point

The point at which total revenue equals total costs and expenses, resulting in neither profit nor loss.

Dollar Sales

The total value of sales made by a business within a certain period, measured in dollars.

Selling Price

The amount of money for which a product or service is sold to the customer.

Q9: Mccaughan Corporation bases its predetermined overhead rate

Q13: Dietzen Corporation has two manufacturing departments--Casting and

Q13: Torri Manufacturing Corporation has a traditional costing

Q76: The fact that one department may be

Q81: A contribution format income statement separates costs

Q135: Durphey Corporation has provided the following data

Q144: Assume that the company uses departmental predetermined

Q169: An example of a committed fixed cost

Q183: The estimated total manufacturing overhead for the

Q261: Pebbles Corporation has two manufacturing departments--Casting and