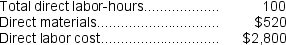

Kubes Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $90,000, variable manufacturing overhead of $3.50 per direct labor-hour, and 30,000 direct labor-hours. The company has provided the following data concerning Job A477 which was recently completed:

-The predetermined overhead rate for the Assembly Department is closest to:

Definitions:

Good Cause Clause

A provision in contracts that allows for termination of the agreement under specified conditions that are deemed to be legitimate or of "good cause."

Specified Area

A designated or defined geographic or operational space allocated for a particular purpose or activity.

Intangible Asset

An asset that lacks physical substance, such as intellectual property, goodwill, or brand recognition.

Patent Right

A legal entitlement granted to an inventor or assignee to exclusively exploit an invention for a certain period, preventing others from selling, making, or using the invention without permission.

Q44: How much is Kapanga's work in process

Q66: In a contribution format income statement for

Q103: Maysonet Corporation uses a job-order costing system

Q113: Eppich Corporation has provided the following data

Q129: A manufacturing company prepays its insurance coverage

Q147: If the overhead rate is computed annually

Q211: The relevant range concept is applicable to

Q224: Assume that the company uses a plantwide

Q268: The estimated total manufacturing overhead for the

Q285: The gross margin for October is:<br>A) $1,424,500<br>B)