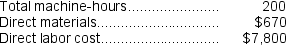

Teasley Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours.The company based its predetermined overhead rate for the current year on 70,000 machine-hours,total fixed manufacturing overhead cost of $630,000,and a variable manufacturing overhead rate of $3.40 per machine-hour.Job X159 was recently completed.The job cost sheet for the job contained the following data:

Required:

Required:

Calculate the total job cost for Job X159.

Definitions:

Batch-Level Activities

These are tasks or operations that are performed for a batch of products, rather than for each individual unit or continuously for the whole process.

First-Stage Allocation

The process by which overhead costs are assigned to activity cost pools in an activity-based costing system.

ABC System

The Activity-Based Costing system that assigns manufacturing overhead costs to products in a more logical manner by taking into account the specific activities that incur costs.

Activity Cost Pools

Groups of related costs that are associated with particular activities, used in activity-based costing.

Q4: How much is the unadjusted cost of

Q13: Dietzen Corporation has two manufacturing departments--Casting and

Q14: During June,Briganti Corporation purchased $79,000 of raw

Q20: Werger Manufacturing Corporation has a traditional costing

Q27: Dallman Corporation uses a job-order costing system

Q48: Crowson Corporation uses a job-order costing system

Q161: Petru Corporation uses a job-order costing system

Q233: What would be the total variable inspection

Q275: Assume that the company uses departmental predetermined

Q288: Committed fixed costs represent organizational investments with