(Appendix 2A) Adelberg Corporation makes two products: Product A and Product B. Annual production and sales are 500 units of Product A and 1,000 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.2 direct labor-hours per unit. The total estimated overhead for next period is $68,756.

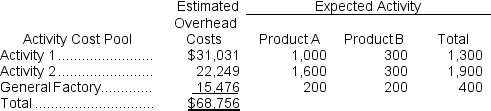

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

-The predetermined overhead rate under the traditional costing system is closest to:

Definitions:

Rival Consumption

A situation where the consumption of a good by one individual prevents simultaneous consumption by other individuals.

Excludable

A characteristic of a good or service where it's possible to prevent individuals who have not paid for it from having access.

Television Signal

The electronic waves transmitted from a broadcast station that carry audio and visual information to televisions.

Nonrival Consumption

A characteristic of goods where one person's consumption does not reduce availability or enjoyment of the good for others.

Q8: Dizzy employees a certified operator for each

Q30: To maintain trustworthy customer relationships,companies must take

Q42: Which of the following is the correct

Q90: The direct materials cost for July is:<br>A)

Q111: A factory supervisor's wages are classified as:<br><img

Q146: The amount of overhead applied to Job

Q165: Valvano Corporation uses a job-order costing system

Q203: The ending balance in the Work in

Q247: All of the following can be differential

Q260: The amount of overhead applied in the