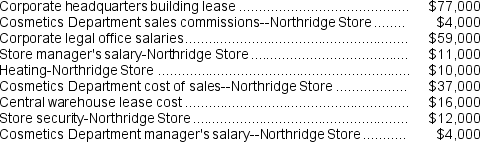

The following cost data pertain to the operations of Quinonez Department Stores, Inc., for the month of September.

The Northridge Store is just one of many stores owned and operated by the company. The Cosmetics Department is one of many departments at the Northridge Store. The central warehouse serves all of the company's stores.

The Northridge Store is just one of many stores owned and operated by the company. The Cosmetics Department is one of many departments at the Northridge Store. The central warehouse serves all of the company's stores.

-What is the total amount of the costs listed above that are NOT direct costs of the Northridge Store?

Definitions:

Average Tax Rate

Total amount of tax paid divided by total income.

Total Taxes

The aggregate amount of taxes collected by a government from individuals and businesses.

Taxable Income

The portion of an individual or entity's income that is subject to taxation, after deductions and exemptions, according to the law.

Deductions

Expenses or specific amounts that can be subtracted from one's gross income to reduce the taxable income.

Q40: Before approaching a potentially major B2B customer,a

Q42: If 5,000 units are produced,the total amount

Q48: Crowson Corporation uses a job-order costing system

Q78: Molash Corporation has two manufacturing departments--Machining and

Q93: Saxbury Corporation's relevant range of activity is

Q109: Warren is debating between spending the money

Q127: The variable cost per unit depends on

Q144: When the level of activity decreases within

Q144: What are PSAs? Why do television and

Q197: The total job cost for Job X455