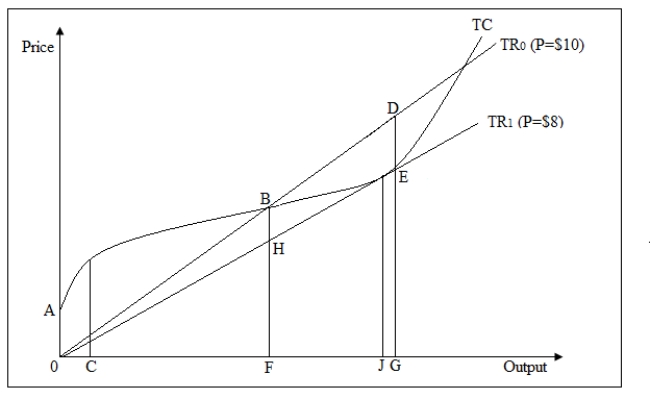

The following figure shows the total cost and total revenue for a firm when it prices its products at $8 and $10.

Figure 9-1

-In Figure 9-1,if the market price fell to $8 the firm would:

Definitions:

Current Yield

The annual income (interest or dividends) divided by the current price of the security, often used in relation to bonds to describe the percentage return based on the bond's current market price.

Coupon Bonds

Bonds that pay the holder a fixed interest rate (coupon) over the life of the bond, and then return the principal at maturity.

Par Value

The nominal or face value of a bond, share of stock, or other financial instrument, as stated by the issuing entity.

At Issue

A term often used when new securities are released to the market, indicating they are currently being offered for sale to the public.

Q4: As long as there is free entry

Q13: If a commodity has a(n)_,a greater share

Q16: Refer to Figure 9-4.The firm's average fixed

Q16: In the Stackelberg model of oligopoly,the dominant

Q44: An allocation of resources is inefficient if,through

Q48: Refer to Figure 9-4.At a price of

Q73: In Figure 19-1,the curve TT shows:<br>A)a single

Q82: Derive the first-order and second-order conditions for

Q82: Which of the following is an advantage

Q97: In Figure 7-2,average product reaches a maximum