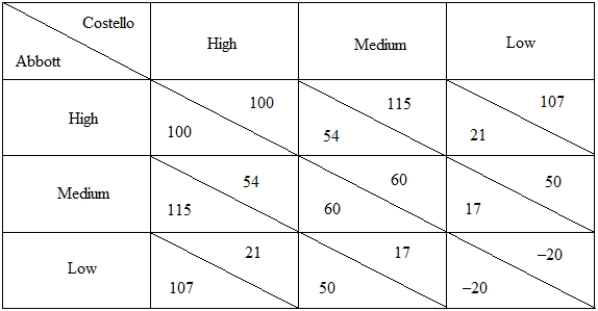

Abbott and Costello are two firms that compete with each other in the market for ice-cream.They can price their product at a high,medium,or low price.The following matrix shows their profits from their respective pricing strategies.

Table 15-3

-Refer to Table 15-3.What is the highest payoff from Abbott's dominated strategy?

Definitions:

Payback Method

A capital budgeting technique that estimates the time required to recoup the initial investment in a project.

Cash Flows

The inflows and outflows of cash and cash equivalents, representing the operating, investing, and financing activities of an entity.

Net Present Value

The difference between the present value of an investment project’s cash inflows and the present value of its cash outflows.

Internal Rate

Internal Rate, often referred to as Internal Rate of Return (IRR), is the rate of growth a project is expected to generate, used in capital budgeting to estimate the profitability of potential investments.

Q9: Which of the following is the best

Q15: Which of the following is not necessarily

Q22: Explain with the help of a suitable

Q57: In the long-run,capital will be allocated across

Q57: In the Cournot duopoly model,the reaction curve

Q59: Consider a machine that costs $50,has an

Q61: The excess of price over marginal cost

Q74: Which of the following would take place

Q76: The shape of a competitive firm's input

Q92: Which of the following is a key