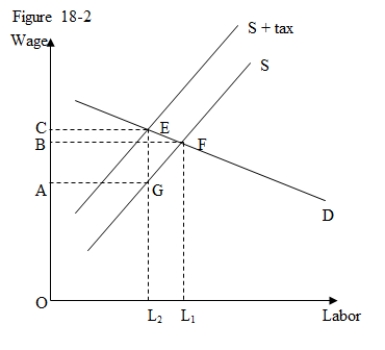

The figure given below shows the demand and supply curves of labor.A per-unit tax imposed on the wage income of the employees shifts the supply curve of labor upward.

-According to Figure 18-2,the proportion of the per-unit tax paid by employees is:

Definitions:

Corporate Dividend Payout

The portion of earnings distributed to shareholders in the form of dividends.

Firm's Earnings

The profit of a company after all expenses and taxes have been deducted from revenue, indicating the company’s financial performance over a specified period.

Ex-Dividend Date

The specific date on which a declared dividend is set, after which a stock buyer is not entitled to the declared dividend.

Date of Record

This is the date set by a corporation upon which the shareholders must be on the company's books in order to receive a declared dividend or participate in corporate actions.

Q7: Sampson Seadoos manufactures state-of-the-art seadoos.In 2015,the company's

Q7: When the average cost curve declines after

Q11: For firms with constant and equal long-run

Q13: (<br>A)Explain how the free rider problem might

Q28: Which of the following best describes wage

Q43: When all inputs are variable,a competitive firm's

Q66: Jane,who works at a publishing firm,chooses to

Q74: In the Stackelberg model,the leader firm's residual

Q81: Which of the following is true for

Q84: Health insurance companies often place limitations on