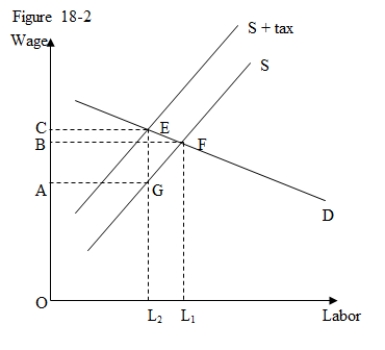

The figure given below shows the demand and supply curves of labor.A per-unit tax imposed on the wage income of the employees shifts the supply curve of labor upward.

-According to Figure 18-2,the proportion of the per-unit tax paid by employees is:

Definitions:

Consumer Demand

The desire and willingness of consumers to purchase goods or services at a given price, influencing market dynamics and pricing strategies.

Consumer Surplus

The gap between the total amount consumers are prepared and able to spend for a product or service versus what they genuinely spend.

Maximum Price

The highest price that can legally be charged for a good or service, often set by government regulations to protect consumers from excessively high prices.

Market Failure

A situation in which the allocation of goods and services is not efficient, often leading to a net social welfare loss.

Q10: Refer to the payoff matrix in Table

Q22: Refer to Table 15-1.If X = 145

Q43: The following are some of the characteristics

Q44: In general,which statement is correct?<br>A)Lessees prefer finance

Q68: Based on Figure 15-2,it can be concluded

Q68: Assume that labor and capital are the

Q76: If X = 15 and Y =

Q79: The National Collegiate Athletic Association [NCAA] is

Q89: Explain how a change in each of

Q91: When might a compensating wage differential go