Changing Assumptions Ltd.has the following details related to its defined benefit pension plan as at December 31,2013: Pension fund assets of $1,900,000 and Actuarial obligation of $1,806,317.

The actuarial obligation represents the present value of a single benefit payment of $3,200,000 that is due on December 31,2019,discounted at an interest rate of 10%;i.e. ,$3,200,000 / 1.106 = $1,806,317.

The pension has no unamortized experience gains or losses,and no past service costs at the end of 2013.Funding during 2014 was $55,000.The actual value of pension fund assets at the end of 2014 was $2,171,000.As a result of the current services received from employees,the single payment due on December 31,2019 had increased from $3,200,000 to $3,380,000.

Required:

a.Compute the current service cost for 2014 and the amount of the accrued benefit obligation at December 31,2014.Perform this computation for interest rates of 8%,10%,and 12%.

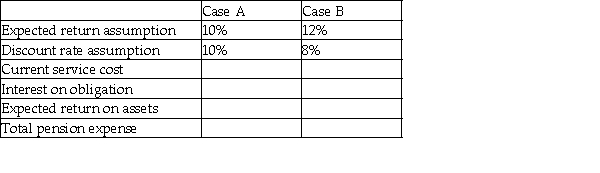

b.Derive the pension expense for 2014 under various assumptions about the expected return and discount rate.Complete the following table:

c.Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate.How does a change in the discount rate affect the accrued benefit obligation?

Definitions:

Q8: The following summarizes information relating to Gonzalez

Q25: If 10,000 shares with par value of

Q26: Traditional Bathrooms Inc.(TBI)had 80,000 ordinary shares outstanding

Q27: Raysport Inc.sells $1,000,000 of three-year bonds on

Q33: What entry is required for the lessor

Q39: What are positive and negative covenants? Give

Q39: A pension plan promises to pay $70,000

Q59: A uniform per-unit tax on pollution achieves

Q69: Which statement is correct about the "guaranteed

Q69: Under the accrual method,what is the effect