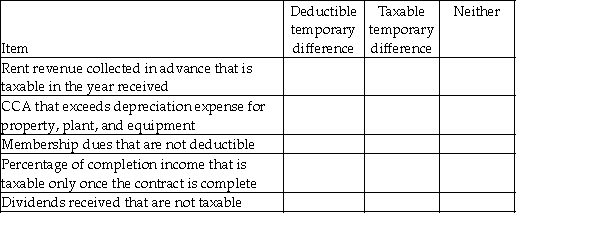

Indicate whether the item will result in a deductible temporary difference,taxable temporary difference or neither.

Definitions:

Jury Duty Pay

Compensation received by a juror for performing jury service in a court, which is considered taxable income.

Deducted

Subtracted or taken away from a total amount, often in the context of calculating taxable income or expenses.

Stock Dividend

A dividend payment made by a company to its shareholders in the form of additional shares, rather than cash.

Taxable

Subject to taxation by governmental authorities.

Q8: On January 1,2017,Adara acquired equipment under a

Q14: Which of the following will hold true

Q36: Which statement is not correct about financial

Q56: Define "a retrospective adjustment."

Q59: Why do the supporting indicators for lease

Q60: Assume that MAK agrees to purchase US$500,000

Q67: Which statement best describes the "deferral method"?<br>A)This

Q76: Sarah Braun is the owner of Sarah's

Q87: Which statement is correct?<br>A)HST payable is a

Q88: Which entry is needed by the lessee