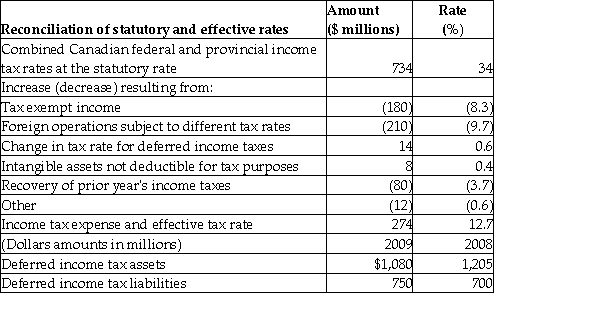

For the year ended October 31,2018,NB Financial Group (National Bank)reported income before tax of $2,160 million and income tax expense of $274 million,for an effective tax rate of 12.7% ($274m / $2,160m).In the notes to the financial statements,NB's disclosures included the following information:

Required:

a.From NB's disclosures provided above,identify any permanent differences.

b.In which direction did the tax rate change from 2017 to 2018?

c.Refer to the line "Recovery of prior years' income taxes" in the above disclosures.What does this information imply about NB's treatment of tax losses in prior years?

Definitions:

Income Rises

An increase in the amount of money received by individuals or entities, typically through wages, dividends, or investments.

Elastic Demands

Demand for a product or service that significantly changes in response to price changes, indicating high price sensitivity among consumers.

Luxuries

Luxuries refer to goods or services that are considered non-essential but desirable and are often associated with higher quality and price points than necessities.

Price Elastic Demand

Describes a situation where the quantity demanded of a good or service significantly changes in response to a change in its price.

Q9: Which statement is correct about the "taxes

Q12: Calculate the share effect on the incremental

Q20: How should employee stock options be accounted

Q24: Jamieson Inc.issues US$1,000,000 of two-year bonds on

Q34: On June 1,2017,Bean LTD.provides a vendor with

Q38: According to Figure 20-1,the efficient output is

Q50: For the following lease,determine the minimum

Q55: Contrast the differences between IFRS and ASPE

Q62: Describe the options available for reporting held-for-trading

Q94: A tax used to internalize an external