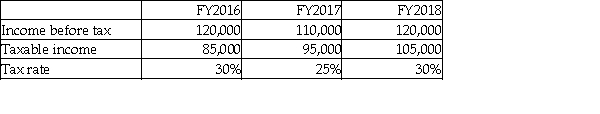

What is the tax expense under the deferral method for FY2016?

Definitions:

Voting Rights Act Of 1965

A landmark piece of federal legislation in the United States that prohibits racial discrimination in voting.

Literacy Tests

Historically used in the United States as a method to disenfranchise voters, particularly African Americans, by requiring them to pass reading and writing tests before being allowed to vote.

Voter Registration

The process by which eligible citizens enroll or sign up to be able to participate in electing their government officials.

Yazoo City

A city located in Mississippi, USA, known for its historical significance and cultural heritage.

Q8: The following summarizes information relating to Gonzalez

Q36: For a company using the straight-line method

Q46: Free rider behavior is:<br>A)always irrational since the

Q47: Which is an example of a liability?<br>A)The

Q51: Which statement is correct?<br>A)Dividends are never discretionary

Q54: Under the accrual method,what is the effect

Q55: Which statement about contributed surplus is correct?<br>A)Contributed

Q88: What is a "covenant"?<br>A)Guarantee of the price

Q94: Under the accrual method,what is the effect

Q103: On January 1,2017,Rushabh Company entered a lease