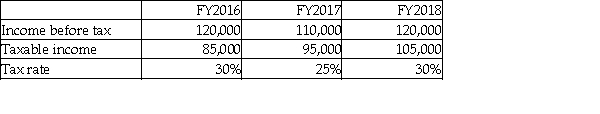

What is the tax expense under the deferral method for FY2017?

Definitions:

Straight-Line Depreciation

A method of allocating an asset's cost evenly across its useful life, assuming a constant rate of depreciation.

Marginal Tax Rates

The tax rate applicable to the last dollar of an individual's or entity's taxable income.

Pre-Tax Loan Rate

The interest rate on a loan calculated before taxes have been deducted.

CCA Class

Refers to the classification of fixed assets under the Canadian Capital Cost Allowance for the purpose of tax depreciation.

Q3: BA Paint Ltd.was incorporated on January 1,2019.The

Q6: Two different companies have many similarities,including the

Q10: How are derivative contracts generally accounted for?<br>A)Fair

Q20: Which statement best explains the meaning of

Q22: For the year ended October 31,2018,NB Financial

Q28: Why do the supporting indicators for lease

Q32: What are past service costs in a

Q38: Compare the impact of finance leases and

Q54: When an economic activity generates a benefit

Q78: What is an investing activity?<br>A)Activities involving the