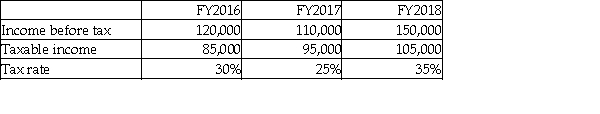

What is the deferred tax liability under the deferral method for FY2018?

Definitions:

Straight-line

A method of calculating depreciation of an asset where the expense is evenly distributed over its useful life.

Effective-interest

A method of calculating the interest rate on a loan or financial product that takes into account compound interest and fees, providing a true annual rate.

Amortization

The method of distributing the expense of a non-physical asset across its lifespan.

Market Rate

The prevailing rate of interest available in the marketplace for securities or loans.

Q8: Which statement explains the risk involved in

Q15: Which of the following pollution abatement policies

Q16: In the first year of operations,a company

Q18: Salisbury Creamery leases its ice cream making

Q25: What amount is included in the pension

Q39: Why are retrospective adjustments to past years'

Q57: What are "callable bonds"?<br>A)Bonds that have cash

Q57: As of January 1,2018,the equity section of

Q66: Indicate whether the following statements are true

Q76: Bram Masons' balance sheet shows a defined