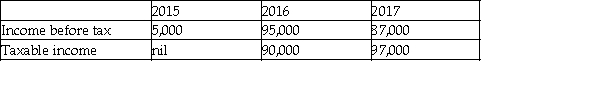

Withering Inc.began operations in 2015.Due to the untimely death of its founder,Edwin Delaney,the company was wound up in 2017.The following table provides information on Withering's income over the three years.

The statutory income tax rate remained at 45% throughout the three years.

Required:

a.For each year and for the three years combined,compute the following:

- income tax expense under the taxes payable method;

- the effective tax rate (= tax expense / pre-tax income)under the taxes payable method;

- income tax expense under the accrual method;

- effective tax rate under the accrual method.

b.Briefly comment on any differences between the effective tax rates and the statutory rate of 45%.

Definitions:

Redeems

The act of exchanging a financial instrument, such as a bond or preferred stock, for its face value or for a specific commodity.

Gain

A financial increase that results when the sale price of an asset exceeds its purchase price or carrying value, not necessarily related to the core operations.

Loss

Loss occurs when a company's expenses exceed its revenues during a specific period, leading to negative net income.

Interest Expense

The cost incurred by an entity for borrowed funds over a particular period.

Q1: Which statement best explains the "single transaction

Q3: In Figure 20-2,if the efficient output is

Q7: Use the facts from #13,above,to determine how

Q22: Which statement is correct?<br>A)Out of the money

Q23: What is the role of debt rating

Q37: Indicate whether the item will result in

Q38: Which is a correct statement?<br>A)The direct method

Q51: For each of the following differences between

Q72: What is "firm commitment" underwriting?<br>A)Broker's guarantee of

Q90: Which statement is correct?<br>A)Dilutive potential ordinary shares,if