The following data represent the differences between accounting and tax income for Seafood Imports Inc. ,whose pre-tax accounting income is $650,000 for the year ended December 31.The company's income tax rate is 45%.Additional information relevant to income taxes includes the following.

a.Capital cost allowance of $270,000 exceeded accounting depreciation expense of $160,000 in the current year.

b.Rents of $25,000,applicable to next year,had been collected in December and deferred for financial statement purposes but are taxable in the year received.

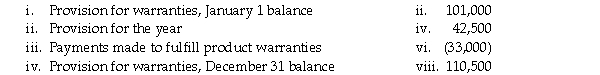

c.In a previous year,the company established a provision for product warranty expense.A summary of the current year's transactions appears below:

For tax purposes,only actual amounts paid for warranties are deductible.

d.Insurance expense to cover the company's executive officers was $6,800 for the year,and you have determined that this expense is not deductible for tax purposes.

Required:

Prepare the journal entries to record income taxes for Seafood Imports.

Definitions:

Collaboration Component

An essential element or aspect of working together cooperatively towards a common goal.

Micro-Sociological Perspective

A viewpoint in sociology focusing on the everyday interactions and social processes among individuals or small groups.

Symbolic Interactionists

Scholars who focus on understanding society and social interactions through the study of symbols and how individuals interpret and react to them.

Conflict Theorists

Scholars and thinkers who apply the principles of conflict theory to analyze the dynamics of power, inequality, and social change in societies.

Q7: On January 1,2017,Troy Company entered a lease

Q8: The following summarizes information relating to Gonzalez

Q11: Which statement is correct about "agency cost

Q48: What is the pension expense for the

Q49: On January 1,2015,Gilmore Inc.granted stock options to

Q52: To provide information useful to decision makers,IAS

Q64: Which is not an example of a

Q66: Which of the following is an example

Q88: A pension plan promises to pay $75,000

Q112: The following amortization schedule is for a