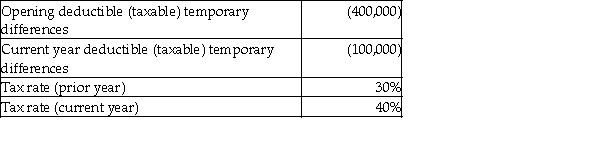

What is the opening balance of the deferred tax liability account considering the rate change?

Definitions:

Accrued Liabilities

Liabilities recorded on a company's balance sheet for expenses that have been incurred but not yet paid, capturing the company's financial obligations at a particular point in time.

Prepaid Expenses

Costs paid in advance for goods or services, which are recorded as assets to be used or recognized as expense over time.

Direct Method

A cash flow statement presentation method that lists the major categories of gross cash receipts and payments.

Accrued Expenses

Expenses that have been incurred but not yet paid, typically recorded at the end of an accounting period.

Q48: Which statement is correct about the financial

Q59: What are the two distinct components to

Q70: The Coase theorem states that when transaction

Q72: Which of the following is correct about

Q72: What is "firm commitment" underwriting?<br>A)Broker's guarantee of

Q75: What is the opening balance of the

Q76: Explain what a "property dividend " is

Q80: Explain the meaning of the following terms:

Q86: When is a corporation legally obligated (liable)to

Q91: Missouri Wheels Ltd.(MW)sold $9,000,000 of fourteen-year,3% bonds