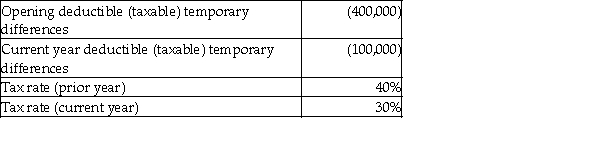

What adjustment is required to the opening deferred taxes as a result of the rate change?

Definitions:

Holder

An individual or entity that legally possesses a negotiable instrument, such as a check or bond, and has the right to collect the value of the instrument.

Blank Indorsements

involves an endorsement on a financial instrument, like a check, that specifies no endorsee, making it payable to the bearer.

Indorser

An individual or entity that signs on the back of a negotiable instrument, thereby transferring ownership or guaranteeing payment to another party.

Beneficial Interest

The right to receive benefits on assets held by another party, such as income from a trust.

Q12: What amount will be presented on the

Q25: Which is a derivative on the company's

Q27: Raysport Inc.sells $1,000,000 of three-year bonds on

Q40: Compute the pension expense and the amount

Q40: A $100,000 5-year 7% bond is issued

Q43: When will there be a recapture of

Q56: Select transactions of Irene Accounting Inc.(IAI)are listed

Q63: For the following lease,determine the minimum

Q64: Which is not an example of a

Q83: Explain how the dividends on cumulative preferred