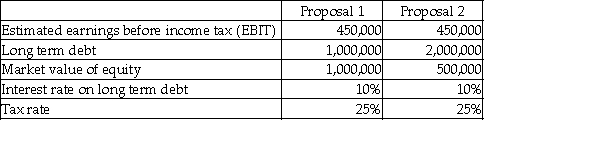

Blue Corp is in the process of acquiring another business.In light of the acquisition,shareholders are currently re-evaluating the appropriateness of the firm's capital structure (the types of and relative levels of debt and equity).The two proposals being contemplated are detailed below:

Required:

a.Calculate the estimated return on equity (ROE)under the two proposals.(ROE = net income after taxes / market value of equity;net income after taxes = (EBIT - interest on long-term debt)× (1 - tax rate)).

b.Which proposal will generate the higher estimated ROE?

c.What is the primary benefit of leveraging an investment decision? What are two drawbacks to leveraging an investment decision?

Definitions:

Accommodation

In psychology, the process of adjusting pre-existing schemas or ideas in response to new information or experiences; in vision, the process by which the eye's lens changes shape to focus near or far objects on the retina.

Subliminal Stimulation

The process of influencing individuals with signals or messages delivered below the threshold of conscious perception.

Visual Cortex

The part of the cerebral cortex responsible for processing visual information, located in the occipital lobe.

Retina

The light-sensitive inner surface of the eye, containing the receptor rods and cones plus layers of neurons that begin the processing of visual information.

Q2: How many columns will the relation LIBRARY

Q24: Jamieson Inc.issues US$1,000,000 of two-year bonds on

Q41: Based on the characteristics provided below,what kind

Q46: On May 1,2017,SBC INC.buys a photocopier listed

Q58: Which statement is correct about basic EPS?<br>A)It

Q66: Indicate whether the following statements are true

Q82: Which of the following is true according

Q90: If A --> B and B -->

Q91: A company had a debt-to-equity ratio of

Q97: Compare and contrast the two methods for