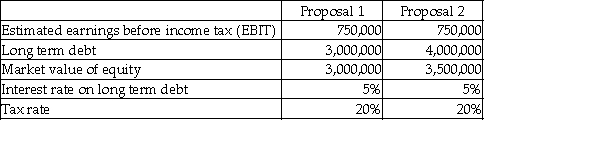

Universal Inc.is in the process of acquiring another business.In light of the acquisition,shareholders are currently re-evaluating the appropriateness of the firm's capital structure (the types of and relative levels of debt and equity).The two proposals being contemplated are detailed below:

Required:

a.Calculate the estimated return on equity (ROE)under the two proposals.(ROE = net income after taxes / market value of equity;net income after taxes = (EBIT - interest on long-term debt)× (1 - tax rate)).

b.Which proposal will generate the higher estimated ROE?

Definitions:

Central Executive

A component of working memory model that is responsible for directing attention and coordinating cognitive processes.

Phonological Loop

A component of working memory responsible for holding and rehearsing verbal and auditory information.

Visuospatial Sketchpad

A component of the working memory that holds and processes visual and spatial information, playing a critical role in navigation and understanding of spatial relationships.

Five-Star Restaurant

An upscale restaurant that has been awarded the highest rating for quality and service by recognized guides or publications.

Q6: How are "purchase discounts lost" reported in

Q11: What is the deferred tax liability under

Q18: Functional dependency Make --> OwnerName exists in

Q37: What is an actuarial gain?<br>A)An unfavourable difference

Q48: Every relation without transitive functional dependencies is

Q58: Which statement about a "reverse stock split"

Q63: Which statement is correct?<br>A)When convertible securities are

Q68: Which statement is correct?<br>A)The income tax system

Q73: Canaroo Inc.sold $800,000 of two-year bonds for

Q93: Give 4 examples of cash flow hedges: