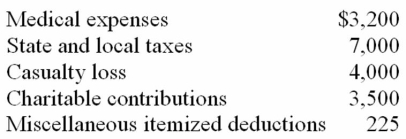

Mr. and Mrs. Hunt have the following allowable itemized deductions this year.  Determine the effect on the amount of each deduction if the Hunts engage in a transaction generating $10,000 additional AGI this year.

Determine the effect on the amount of each deduction if the Hunts engage in a transaction generating $10,000 additional AGI this year.

Definitions:

Team Size

The number of individuals constituting a team, which can influence its functionality, communication, and overall effectiveness.

Stress And Pressure

The psychological and physical state that arises when demands exceed the personal and social resources an individual is able to mobilize.

Novel Task

A new or unique task that has not been performed previously, often requiring innovative thinking and approaches.

Well-Learned Task

A task that an individual or team can perform efficiently and effectively due to extensive practice and familiarity.

Q7: I obtained a baseline level of John's

Q9: Which of the following should increase the

Q17: Mrs. Kronin received $16,200 child support payments

Q18: Exhibit 12-2 The following information is used

Q25: Which of the following would not be

Q36: Suppose that Dr.Jeffers uses 10 participants in

Q62: Mr. Allen, whose marginal tax rate is

Q73: Harris Corporation's before-tax income was $400,000. It

Q75: Ms. Poppe, a single taxpayer, made three

Q102: Qualified dividend income earned by an individual