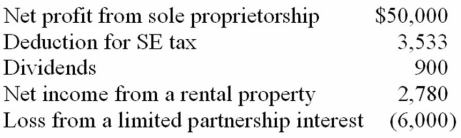

Mr. and Mrs. Nelson operate a small business as a sole proprietorship. This year, they have the following tax information.  Compute Mr. and Mrs. Nelson's AGI.

Compute Mr. and Mrs. Nelson's AGI.

Definitions:

Cost of Goods Sold

Costs directly linked to the creation of goods that a company sells, encompassing both material and labor expenses.

Cash Paid

The actual amount of money disbursed for expenses, purchases, or liabilities.

Accounts Receivable

Funds that customers owe to a business for products or services already provided but not paid for.

Credit Sales

Sales made by a business where the customer is allowed to pay at a later date.

Q4: Both individual and corporate taxpayers must pay

Q5: Homer currently operates a successful S corporation.

Q6: Melissa, age 16, is claimed as a

Q9: This year, David paid his physician $6,200

Q17: A researcher conducts a study to bring

Q35: Researchers design a study to test the

Q36: Which of the following statements about subpart

Q43: The last stage of the scientific method

Q74: Tri-State's, Inc. operates in Arkansas, Oklahoma, and

Q101: The sales factor in the UDITPA state