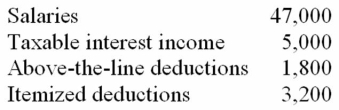

Mr. and Mrs. Liddy, ages 39 and 41, file a joint return and have no dependents for the year. Here is their relevant information.  Compute their adjusted gross income (AGI) and taxable income.

Compute their adjusted gross income (AGI) and taxable income.

Definitions:

Cost of Goods Manufactured

This represents the total production cost of goods that are finished and available for sale during a specific accounting period, including materials, labor, and overhead.

Work in Process

Goods that are in the production process but are not yet finished, representing partially completed products.

Finished Goods

Items that have finished the production process and are available for purchase.

Overhead Applied

The allocation of overhead costs to specific jobs or cost objects based on a predetermined overhead rate, helping in accurately costing products or services.

Q8: V&P Company exchanged unencumbered investment land for

Q15: Fifteen years ago, Lenny purchased an insurance

Q16: AMT adjustments can only increase a corporation's

Q26: A _ describes events that occur with

Q26: Mary Stone, a single individual, sold a

Q37: Tropical Corporation was formed in 2007. For

Q69: An affiliated group consists of a parent

Q72: Mrs. Raines died on June 2, 2011.

Q81: A nondeductible charitable contribution is a permanent

Q84: Mr. and Mrs. Kay, ages 68 and