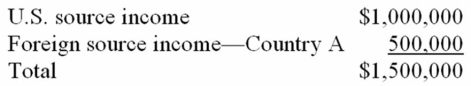

Fleming Corporation, a U.S. multinational, has pretax U.S. source income and foreign source income as follows.  Fleming paid $200,000 income tax to Country A. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.

Fleming paid $200,000 income tax to Country A. If Fleming takes the foreign tax credit, compute its worldwide tax burden as a percentage of its pretax income.

Definitions:

Life Transition

Significant changes in an individual's life which require adjustment, such as career change, marriage, or retirement.

Psychological Identity

An individual's sense of self based on their thoughts, feelings, and experiences.

Hyde Amendment

A legislative provision barring the use of federal funds for most abortions, with exceptions typically allowed only in cases of life endangerment, rape, or incest.

Federal Money

Financial resources provided by the federal government to states, organizations, or individuals, often in the form of grants, subsidies, or loans.

Q25: In which of the following is not

Q25: This year, Mr. and Mrs. Lebold paid

Q31: Southern, an Alabama corporation, has a $7

Q33: Individual taxpayers can obtain an automatic extension

Q35: Kate recognized a $25,700 net long-term capital

Q62: Supplies, Inc. does business in Georgia (6%

Q66: Which of the following statements about nontaxable

Q68: Contributions of property to S corporations are

Q77: Which of the following is a capital

Q89: Gain or loss realized on the disposition