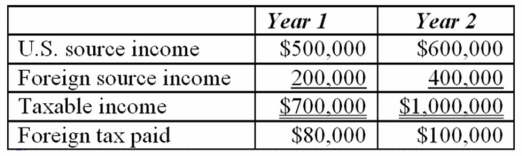

Jenkin Corporation reported the following for its first two taxable years.  Calculate Jenkin's U.S. tax liability for Year 2.

Calculate Jenkin's U.S. tax liability for Year 2.

Definitions:

Cash Payments

Transactions in which payment for goods or services is made in cash at the time of the transaction.

Liabilities

Financial obligations or debts that a company owes to others, which must be settled over time through the transfer of economic benefits.

Debts

Obligations or amounts of money that are owed by a person, company, or country to creditors.

Accounts Payable

A liability account that represents amounts a company owes to suppliers or creditors for goods and services received but not yet paid for.

Q21: Sue's 2012 net (take-home) pay was $23,805.

Q33: Individual taxpayers can obtain an automatic extension

Q42: The interest earned on a state or

Q52: Gary is a successful architect who also

Q57: Tom Johnson, whose marginal tax rate on

Q58: The accumulated earnings tax is assessed at

Q60: Mr. and Mrs. Meredith own a sole

Q63: Partners may deduct on their individual income

Q65: The foreign tax credit is available for

Q72: Mrs. Raines died on June 2, 2011.