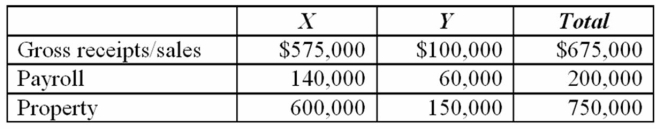

Origami does business in states X and Y. State X uses an equally-weighted three-factor apportionment formula and has a 4 percent state tax rate. State Y uses an apportionment formula that double-weights the sales factor and has a 6 percent tax rate. Cromwell's taxable income, before apportionment, is $3 million. Its sales, payroll, and property information are as follows.  a. Calculate Origami's apportionment factors, income apportioned to each state, and state tax liability.

a. Calculate Origami's apportionment factors, income apportioned to each state, and state tax liability.

b. State Y is considering changing its apportionment formula to a single sales factor. Given its current level of activity, would such a change increase or decrease Origami's state income tax burden? Provide calculations to support your conclusion.

Definitions:

Quo Warranto Action

A legal proceeding used to challenge an individual's right to hold a public office or a corporation's legal existence.

Annual Reports

Comprehensive reports on a company's activities throughout the preceding year, intended to provide stakeholders with financial and operational information.

State Attorney General

The chief legal officer of a state, responsible for representing the state in legal matters, overseeing its legal affairs, and providing legal advice to the state government.

Business Judgment Rule

A principle that protects company directors and officers from liability for decisions made in good faith that are believed to be in the best interest of the company.

Q28: Transfer prices cannot be used by U.S.

Q33: Mr. Dilly has expenses relating to a

Q40: Kyrsten Haas expects her S corporation to

Q50: In 1996, Mr. Exton, a single taxpayer,

Q61: Which of the following statements regarding S

Q77: Mr. and Mrs. Nguyen reported $70,200 AGI

Q78: The income earned by a foreign branch

Q89: The taxable income earned by a personal

Q96: One disadvantage of the creation of a

Q98: The value of employer-provided health insurance is